CT DRS CERT-125 2006-2025 free printable template

Show details

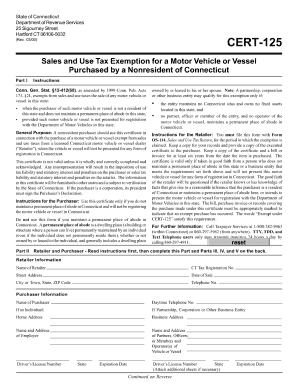

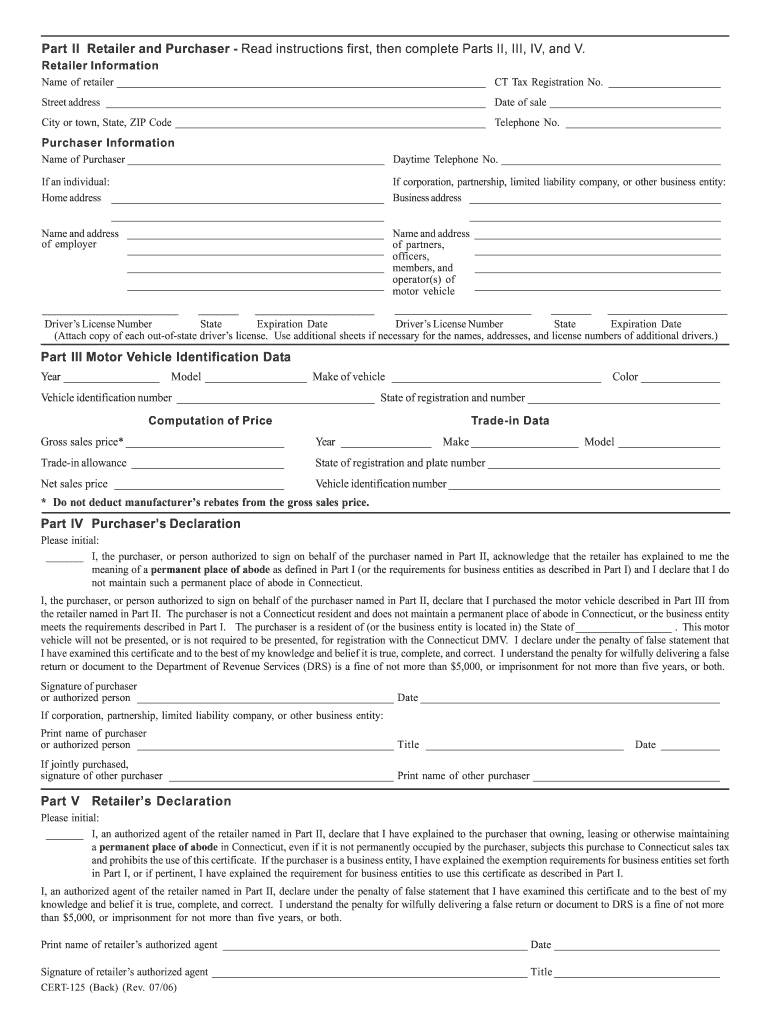

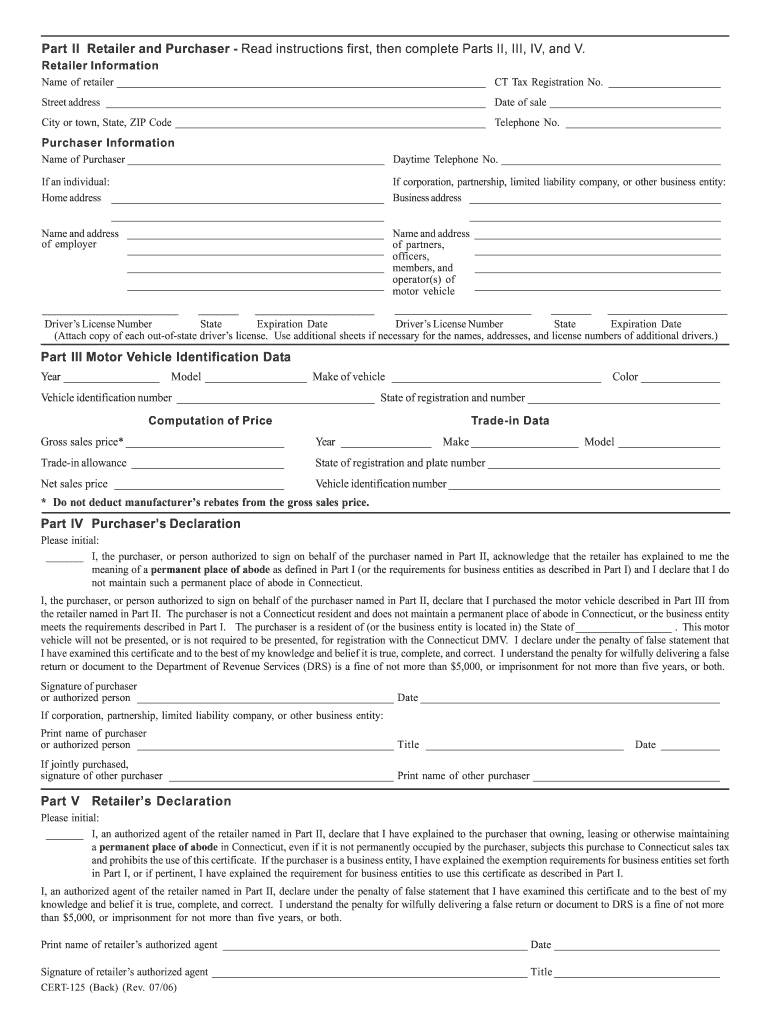

Department of Revenue Services State of Connecticut 25 Sigourney Street Hartford CT 06106-5032 CERT-125 Rev. 07/06 Sales and Use Tax Exemption for a Motor Vehicle Purchased by a Nonresident of Connecticut Part I Instructions Conn. Gen. Stat. 12-412 60 exempts from sales and use taxes the sale of any motor vehicle in this state A corporation partnership limited liability company or other business entity may qualify for this exemption only if When the purchaser of the motor vehicle is not a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign cert 125 pdf form

Edit your ct cert 125 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CT DRS CERT-125 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CT DRS CERT-125 online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CT DRS CERT-125. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out CT DRS CERT-125

How to fill out CT DRS CERT-125

01

Begin by downloading the CT DRS CERT-125 form from the Connecticut Department of Revenue Services website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out the identification section with your name, address, and contact information.

04

Provide any necessary taxpayer identification numbers, such as your Social Security Number or Employer Identification Number.

05

Complete the relevant sections regarding income or tax credits, ensuring accuracy in all amounts.

06

Attach any required documentation or supporting evidence as specified in the form instructions.

07

Review your completed form to ensure all information is accurate and legible.

08

Sign and date the form where indicated.

09

Submit the form according to the instructions, either by mail or electronically if available.

Who needs CT DRS CERT-125?

01

Individuals or businesses who qualify for tax exemptions or benefits in Connecticut may need to fill out the CT DRS CERT-125 form.

02

Tax professionals or preparers may also need this form to assist clients in claiming applicable tax credits.

Fill

form

: Try Risk Free

People Also Ask about

Can you register a car with a bill of sale and no title in CT?

Related resources. A Bill of Sale document is always required along with proof of ownership to process a new vehicle registration. Vehicles that are exempt from emissions testing will require a VIN verification. If a vehicle is a model year four years or older from the current year, the vehicle needs an emissions test.

How do I get a q1 form in CT?

Vehicle owners can transfer ownership of a vehicle with the DMV Supplemental Assignment of Ownership form (Form Q-1) and/or the vehicle bill of sale. The Q-1 form is available at your local CT DMV office.

How long does it take to get a title from CT DMV?

The processing time for a title can take approximately 30 days or longer to be completed after the date of the vehicle registration. Access the appropriate documentation and forms necessary to request a duplicate title. Forms can be completed by the owner and mailed to DMV.

Can you register a car without a title in CT?

If a vehicle was purchased in CT and it is newer than 20 years old, you will need a title. Vehicles with a model year more than 20 years prior to the current year are non-titled and a title is not required.

Can I sell a car without a title in CT?

Your vehicle can be sold if the original Connecticut Certificate of Title has been lost, the purchaser will be registering the vehicle in Connecticut, and the vehicle is titled in your name. If these three conditions aren't met, you will need to apply for a replacement title, known as a “duplicate title.”

What is the tax exempt form for lodging in CT?

CERT-112 allows an exempt entity to purchase meals or lodging, or both, tax exempt for a single event and may not be used for repeat purchases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CT DRS CERT-125 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like CT DRS CERT-125, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I get CT DRS CERT-125?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific CT DRS CERT-125 and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my CT DRS CERT-125 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your CT DRS CERT-125 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is CT DRS CERT-125?

CT DRS CERT-125 is a form provided by the Connecticut Department of Revenue Services used for certain tax-related certifications. It is commonly used for claiming exemptions or providing certification for specific tax purposes.

Who is required to file CT DRS CERT-125?

Entities or individuals who are claiming tax exemptions or providing certain certifications, such as nonprofit organizations or businesses involved in specific transactions, are required to file CT DRS CERT-125.

How to fill out CT DRS CERT-125?

To fill out CT DRS CERT-125, you must provide accurate information regarding your entity, the nature of the exemption you are claiming, and any pertinent identification numbers. Ensure all sections are completed as instructed and submit it to the appropriate authority.

What is the purpose of CT DRS CERT-125?

The purpose of CT DRS CERT-125 is to facilitate the process of claiming tax exemptions and certifications within the state of Connecticut, ensuring compliance with state tax regulations.

What information must be reported on CT DRS CERT-125?

CT DRS CERT-125 requires reporting information such as the entity's name, address, tax identification number, details about the exemption being claimed, and signatures from authorized personnel.

Fill out your CT DRS CERT-125 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CT DRS CERT-125 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.